What’s Trending | Research2021 Herbers & Company Financial Behaviors Study

What’s the value of a financial advisor? Happiness.

√ The Herbers & Company’s 2021 Financial Behaviors Study reveals that people who’ve hired a financial advisor are 3x happier than those who don’t.

√ There are four predictors of happiness within financial consumers: fulfillment, intention, impactfulness, and gratefulness that contribute to cumulative happiness.

Turns out, money can buy happiness—assuming it’s used to hire a financial advisor.

In a survey of 1,000 random consumers across the U.S., Herbers & Company found that those with a financial advisor are statistically happier than those who haven’t hired an advisor. To be included in the study, respondents had to have self-reported assets of $250,000 or more. Slightly over half of the respondents (54%) were male, and 79% were either married or living with a significant other. Before we get too deep into the data, let’s define happiness.

Happiness is the feeling that reflects how well individuals’ needs are being met, and, to a smaller degree, their contentment with their idealized self versus their actual self. Happiness means that a person’s emotional, mental, physical, and relational needs are being met. Money contributes to a person’s ability to meet their needs and those of their families.

To gauge the level of consumer happiness, Herbers & Company created a list of 43 statements. The survey questions, which were derived from core principles of psychotherapy, delved into consumers’ daily behaviors and interactions, which are good indicators of their reality and their overall satisfaction or happiness.

Herbers & Company’s inaugural 2021 Consumer Financial Behavior Survey identified four core factors that make people happier (figure 1): fulfillment, intention, impact and gratefulness.

Figure 1All four predictors of happiness were increased among consumers who work with financial advisors—by a wide margin.

The research found that all four of the happiness factors are heightened among 66% of consumers who work with a financial advisor, versus 34% of those who do not. In other words, people who hire a financial advisor were statistically happier (figure 2) than those who don’t—by a wide margin. This held true even when controlling for gender, age, income and asset levels.

Figure 2Couples who work with a financial advisor increased relationship satisfaction and communication.

It also appears that working with a financial advisor accelerates happiness in other key areas of our lives (figure 3). People who have financial advisors are not only happier with their finances, but they are also far happier about their personal relationships and their communication with their partners.

While it’s possible that happy couples might be more likely to hire financial advisors, it’s also possible that working with a financial advisor gives couples an opportunity to talk about financial goals, and thereby gives them a happiness boost.

Across the board, happiness in the individual levels of relationship satisfaction, couple communication, and personal finances is higher with a financial advisor. And once again, the pattern holds true regardless of gender, age, income or assets.

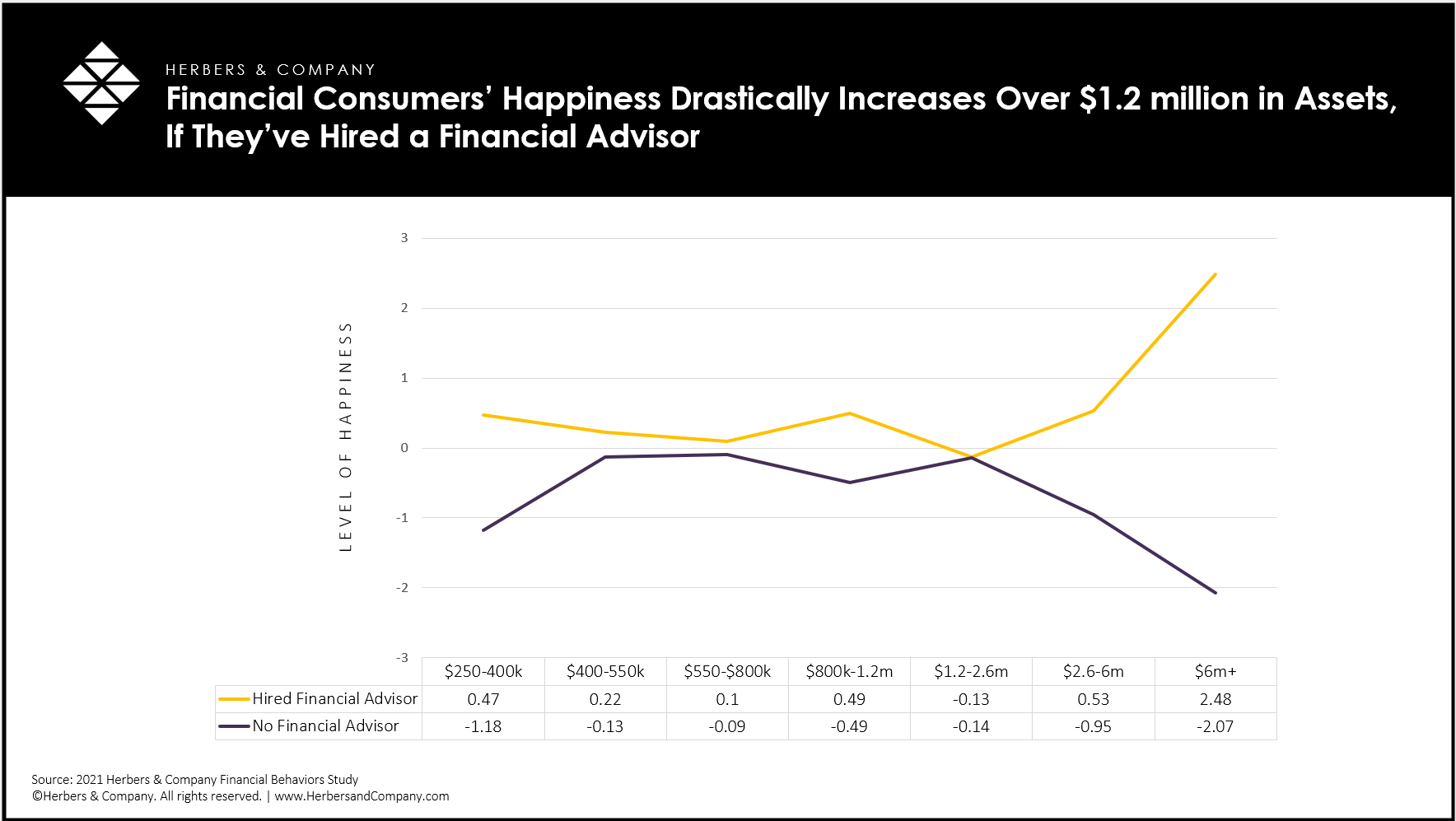

Figure 3Those who make it to the top 5% of wealth, hiring a financial advisor is the difference between being happy or allowing money to decrease happiness.

Despite these findings, there’s a reason we have sayings like “Money can’t buy happiness.” As Figure 4 illustrates, between $1.2-$2.6 million in assets is a critical point at which to hire a financial advisor. For those who make it to the top 5% of wealth in the U.S., working with an advisor can mean the difference between being happy with financial success or allowing money to decrease happiness. It appears that a financial advisor is needed to increase happiness levels above the $1.2 million threshold.

Figure 4So what is the true value of a financial advisor? Yes, they provide investment management advice, financial planning services, and guidance for their clients’ financial futures. More importantly though, hiring financial advisors, sooner rather than later, makes people happier. Finally, for individuals with more than $1.2 million in assets, a financial advisor is critical to happiness.

1 We used a third-party surveying company that hid the identity of Herbers & Company to ensure respondents were not influenced.

2 Veenhoven, 2011

3 Herbers & Company Research then evaluated the face validity of the items in measuring happiness before administering the national survey, where respondents were asked to indicate how strongly they agreed or disagreed with a series of statements where 1 strongly disagree to 7 strongly agree to gauge their happiness. Through our factor analyses, we identified four distinct and highly reliable factors of happiness. Each of our four factors were significantly predictive of happiness with personal finances, and they were predictive of one’s marriage/relationship, and couple communication.

4 We ran ordinary least squares analysis for each of the components against happiness with finances, happiness with relationship, and happiness with partner communication. Each independent variable showed statistical significance as single item predictors at the p < .001 level. When combined into a single regression analysis, impact and intention lose statistical significance in predicting happiness with communication when controlling for fulfillment and gratefulness. We don’t see this as a problem. Each item is still predictive of happiness. The combined summated score of fulfillment, intention, impact, and gratefulness was predictive of happiness in all three areas of finances, relationship, and partner communication.